Sports-betting companies fund jerseys, tournaments, arenas, and even full broadcasts – but each nation applies its own framework for who can sponsor what and how betting promotions appear. From Caliente’s dominance in Mexican football and Betano’s naming rights across Brazil, to ParionsSport (FDJ) teaming up with PSG in France or DraftKings and FanDuel powering U.S. league activations, sponsorships have become a cornerstone of the global iGaming marketing machine.

This worldwide overview breaks down how leading operators invest in leagues and clubs to enhance their image – and how national laws, regulators, and sports federations reshape what’s allowed. Each country section outlines top sponsorships, bookmaker partnerships, and the latest ad restrictions influencing the betting market in 2025.

Chile’s football landscape has shifted sharply since late 2023. The Asociación Nacional de Fútbol Profesional (ANFP) officially canceled its title partnership with Betsson for the premier division (“Campeonato Betsson”) after the Supreme Court reaffirmed that online gambling is illegal without explicit authorization. Valued at roughly USD 8 million across three years, the deal was annulled by the Ministry of Justice, which ordered ANFP to cut ties with offshore sportsbooks.

The complex intersection between regulators, sports bodies, and lawmakers in balancing betting’s role in football and public life. / Source: ABED.com

Before this decision, Betsson had been one of Chile’s most prominent sponsors, also backing Primera B (Campeonato Ascenso Betsson) and multiple local teams. Its exit signaled a new phase – from heavy sportsbook branding during 2022–23 to almost none by 2024–25. Clubs that depended on those contracts now seek non-betting partners, affecting league income.

Despite a restrictive environment, Jugabet has stood out as an exception. In 2024, it became Universidad de Chile’s primary shirt sponsor through a record multimillion-peso agreement – one of the biggest in the club’s modern history. Soon after, Jugabet extended partnerships with Colo-Colo, Ñublense, and Deportes Temuco, making it one of few betting brands still visible across Chilean football.

These deals, signed amid ongoing legal debates, show that some operators remain active while awaiting clearer licensing frameworks. Jugabet’s marketing focuses on brand exposure mixed with digital and community-driven campaigns that emphasize entertainment and responsible play rather than hard-sell tactics.

Other operators – including Coolbet, Betsala, Estelarbet, and Tikitaka – have adopted quieter strategies centered on digital marketing, influencer collaborations, and regional Latin American visibility, staying away from official team inventory to minimize regulatory risk.

According to the Ministry of Justice and the Superintendencia de Casinos de Juego (SCJ), no online sportsbook currently holds domestic approval. Following the Supreme Court’s directive, ISPs began blocking major sites, effectively pausing all football-related sponsorships.

Until the Senate finalizes the framework for taxation, licensing, and advertising, these six operators should consider in-stadium or club-linked sponsorships legally sensitive. Compliant marketing for now means geo-targeted digital ads and offshore media placements that avoid Chilean club intellectual property, aligned with SCJ and ministerial guidance.

Mexico stands out as one of Latin America’s most established betting sponsorship environments. Caliente.mx leads the field, holding exclusive high-profile deals: it serves as the Casa de Apuestas Oficial for Liga BBVA MX, Liga MX Femenil, and Liga Expansión MX, plus it sponsors the Mexican National Team. In 2025, it added the CONCACAF Gold Cup to its portfolio, strengthening its regional dominance.

The industry operates under the Ley Federal de Juegos y Sorteos, overseen by the Dirección General de Juegos y Sorteos (DGJS) within the Secretaría de Gobernación (SEGOB). Only federally licensed entities can promote or sponsor sports organizations.

Caliente’s influence extends beyond logos – it covers stadium naming rights, fan engagement programs, and activations inside arenas. Several Liga MX teams, including Club Tijuana (Xolos) and Club Puebla, showcase Caliente branding on kits and sleeves. These partnerships, all approved under DGJS permits, guarantee broad visibility across both television and stadium audiences.

All betting ads must clearly include license details and responsible-gaming statements. SEGOB and DGJS prohibit misleading content or campaigns targeting minors. Promotions such as “risk-free bets” or unverified bonuses can face penalties. Each campaign must display full terms and avoid inducement phrasing, consistent with Mexico’s consumer-protection principles.

Following PASPA’s repeal in 2018, the United States evolved into the world’s most diverse regulated betting ecosystem. Every state sets its own framework, creating both challenges and opportunity for sponsors. The NFL collaborates with Caesars, DraftKings, and FanDuel; the NBA lists DraftKings and FanDuel as official partners; while MLB aligns with BetMGM and DraftKings.

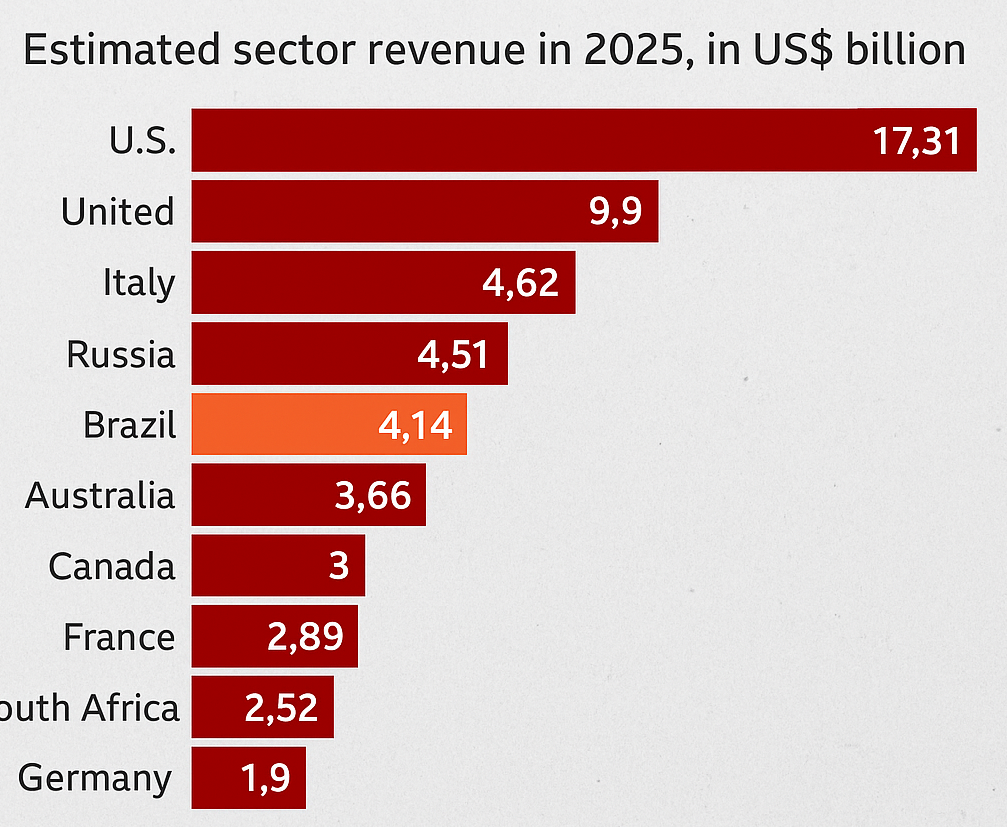

The U.S. remains the largest global market for casino and sports wagering. / Source: BBC

Today, many professional teams integrate betting lounges, branded content, and omni-channel promotions. FanDuel’s sportsbook lounge at Phoenix Suns Arena and Caesars’ space at MetLife Stadium illustrate this trend. Broadcast partnerships with ESPN and Turner Sports further extend sportsbook visibility into live coverage and streaming.

Two main pillars guide U.S. betting marketing: the American Gaming Association’s (AGA) Responsible Marketing Code for Sports Wagering and individual state laws (such as New Jersey’s DGE guidelines). Ads must include responsible-gaming notices, ban “risk-free” claims, and restrict deals involving colleges or celebrity figures appealing to minors.

Despite its vast sports audience, India upholds one of the strictest stances against gambling promotion. The Ministry of Information & Broadcasting (MIB) released several advisories in 2023–24 barring offshore betting ads and surrogate branding, cautioning influencers and media outlets of penalties. The Advertising Standards Council of India (ASCI) also forbids content that glamorizes or normalizes wagering.

No major Indian sports franchise holds a sportsbook sponsorship, given legal uncertainty. Instead, fantasy platforms like Dream11 and My11Circle fill that commercial space – considered skill-based gaming under Indian law. Attempts to use surrogate “sports news” or “tips” sites as betting fronts have mostly disappeared under new enforcement in 2025.

ASCI’s rules require disclaimers for real-money gaming ads and ban the use of minors, national symbols, or aspirational success messages tied to gambling. Any brand must be registered with domestic authorities for marketing approvals, and offshore operators are prohibited from sponsoring Indian teams or competitions.

France’s sports-betting market operates under tight control from the Autorité Nationale des Jeux (ANJ). Licensed operators include ParionsSport (FDJ), Betclic, Winamax, and Unibet. ParionsSport’s headline partnership with Paris Saint-Germain (PSG) remains one of the most visible, while Winamax continues its multi-club presence across Ligue 1 teams such as Lens, Reims, and Rennes.

ParionsSport’s PSG collaboration covers digital activations, co-branded content, and community engagement, extending into women’s football. Winamax runs crossover campaigns that link online events with live tournaments. All agreements comply with ANJ’s guidelines and emphasize responsible gaming.

French law restricts public bonus promotions above €100 and bans content that glamorizes gambling or uses youth-oriented figures. The ANJ’s 2022–2024 communication policy forbids ads on children’s media and mandates visible responsible-gaming messages on all promotional materials.

Canada (Ontario) – Tight Ad Rules and Multi-Team Alliances

After Bill C-218 passed in 2021, Canada legalized single-event sports betting, leaving regulation to provinces. Ontario leads through the Alcohol and Gaming Commission of Ontario (AGCO) and iGaming Ontario. Maple Leaf Sports & Entertainment (MLSE) – owner of the Maple Leafs, Raptors, Toronto FC, and Argonauts – has agreements with FanDuel/PokerStars and PointsBet Canada.

Ontario’s pro teams feature sportsbook logos on broadcasts, digital platforms, and team apps. These partnerships represent a joint effort between regulators and rights-holders to promote betting responsibly under AGCO oversight.

Since February 2024, AGCO has banned active athletes and most celebrities from appearing in betting ads, except for responsible-gaming campaigns. Public “bonus” or inducement promotions are prohibited; ads can only run on owned or direct channels. Every communication must display age limits (19+) and include links to responsible-gaming resources.

Argentina – Provincial Licensing and Iconic Club Deals

Each Argentine province governs gambling independently. The Lotería de la Ciudad (LOTBA) regulates online betting in Buenos Aires City, while IPLyC GBA oversees Buenos Aires Province. Prominent clubs such as River Plate (Codere) and Boca Juniors (Betsson) have secured multimillion-peso front-of-shirt deals, and the AFA holds regional sponsorships with Parimatch and VBET.

River Plate made Codere its main shirt sponsor in 2022, while Boca’s 2023 agreement with Betsson extended to both men’s and women’s squads. These partnerships comply with local licensing rules and AFA oversight.

LOTBA and IPLyC require operators to display responsible-gaming (RG) messaging and limit marketing to adults. Under Decree 181/2019, creatives cannot feature minors or misleading offers. As standards vary by province, operators must confirm jurisdictional approval before launching any campaign.

Brazil – National Licensing and Football Powerhouses

Law 14.790/2023 officially legalized fixed-odds betting, formalizing Brazil’s market after years of uncertainty. Betano stands as the most visible sponsor, holding naming rights for both the Copa do Brasil and the Campeonato Brasileiro Série A. Clubs like Flamengo, Atlético Mineiro, and Fluminense maintain long-term betting partnerships.

By 2025, Flamengo shifted its main sponsorship from Pixbet to Betano, reflecting the move toward federally licensed operators. The Confederação Brasileira de Futebol (CBF) now mandates that only sportsbooks approved by the Ministry of Finance can appear on uniforms or official assets, signaling a new era of regulated professionalism.

The Secretaria de Prêmios e Apostas (SPA) and CONAR regulate all betting promotions. Ads must be age-gated, include responsible-gaming messaging, and avoid using figures appealing to minors. A Senate proposal is under review to further restrict celebrity participation. Full compliance with SPA and CONAR standards is mandatory.

| Country / Market | Main Regulator(s) | Key Betting Sponsors / Examples | Advertising Restrictions |

|---|---|---|---|

| 🇨🇱 Chile | Ministry of Justice / Superintendencia de Casinos de Juego (SCJ) | (No current local deals). Former: Betsson (ANFP). Active digital brands: Jugabet, Coolbet, Betsala, Estelarbet, Megawin, Tikitaka | Ban on sports sponsorships until new law; only offshore or digital advertising allowed |

| 🇲🇽 Mexico | Secretaría de Gobernación (SEGOB) / DGJS | Caliente.mx (official betting house for Liga MX & National Team) | Must include license number & RG message; minors and misleading offers prohibited |

| 🇺🇸 United States | State regulators / AGA self-regulation | DraftKings, FanDuel, Caesars, BetMGM, PointsBet | State rules vary; “risk-free” banned; RG disclaimers mandatory |

| 🇮🇳 India | MIB / ASCI | Fantasy-only: Dream11, My11Circle | Offshore betting ads and surrogate brands banned; influencers monitored |

| 🇫🇷 France | Autorité Nationale des Jeux (ANJ) | ParionsSport (FDJ) x PSG, Winamax, Betclic | Bonus ads capped at €100; RG warnings and ANJ logo required |

| 🇨🇦 Canada (ON) | AGCO / iGaming Ontario | FanDuel/PokerStars, PointsBet Canada (MLSE) | No public inducements; owned-channel only; RG links and 19+ labels required |

| 🇦🇷 Argentina | LOTBA / IPLyC GBA (provincial) | River Plate x Codere, Boca Juniors x Betsson, AFA x Parimatch/VBET | Local licenses only; RG warnings mandatory; minors banned |

| 🇧🇷 Brazil | Ministério da Fazenda / SPA / CONAR | Betano (Copa do Brasil, Série A), Pixbet (Flamengo, Corinthians) | RG message required; no youth content; influencer use restricted |

Across the world, sports-betting sponsorships represent both opportunity and regulation in motion. Mature jurisdictions like France, the U.S., and Ontario show how structured compliance can coexist with innovation. Meanwhile, developing markets such as Chile, Argentina, and Brazil continue to refine how they balance commercial growth with social responsibility.

For marketers and operators – especially those navigating the Chilean landscape – understanding these distinctions remains essential for building compliant and lasting visibility in sport.