KYC – short for “Know Your Customer” – refers to the identity checks an operator performs to confirm you really are the person you claim to be. In Italy’s regulated online casino and sports betting market, KYC isn’t just another administrative formality. It’s a mandatory safeguard aimed at stopping minors from playing, preventing fraud and money laundering, avoiding duplicate or fake accounts, and ensuring both player safety and the integrity of the industry as a whole.

Italy’s KYC rules are shaped by three major regulatory pillars:

ADM stands at the centre of this system. It grants licences, oversees operators, and enforces compliance across the sector. In parallel, Italy’s broader anti-money laundering strategy – outlined in the government’s Piano Nazionale Antiriciclaggio 2022–2025 – strengthens KYC as a fundamental tool to prevent financial crimes.

All these layers explain why Italian KYC standards are so strict: they are designed to lower overall risks while ensuring fairness and transparency for players.

Most licensed operators will ask for the following information:

Depending on your activity or transaction levels, the platform may request additional checks such as income documentation, proof of funds, or a real-time identity session.

Payment methods are also part of the verification ecosystem. Many players choose options like PayPal because they offer solid security, full traceability, and strong alignment with AML requirements.

Modern verification is much faster and more user-friendly than in the past. Operators increasingly provide different verification paths to reduce friction and encourage users to complete registration.

| KYC Method | Average time | Channels | Key advantage | Typical use |

|---|---|---|---|---|

| Document upload + selfie | 2–10 min | App or web + camera | Quick and adaptable | Standard procedure |

| SPID / CIE login | 1–3 min | National digital ID | Highly reliable | Preferred option |

| Bank transfer verification | 1–2 days | Online banking | Confirms account holder | Backup method |

| Video identification | 5–15 min | Guided video call | Very secure | High-risk or EDD checks |

Providing several verification options usually reduces abandonment rates and increases user satisfaction.

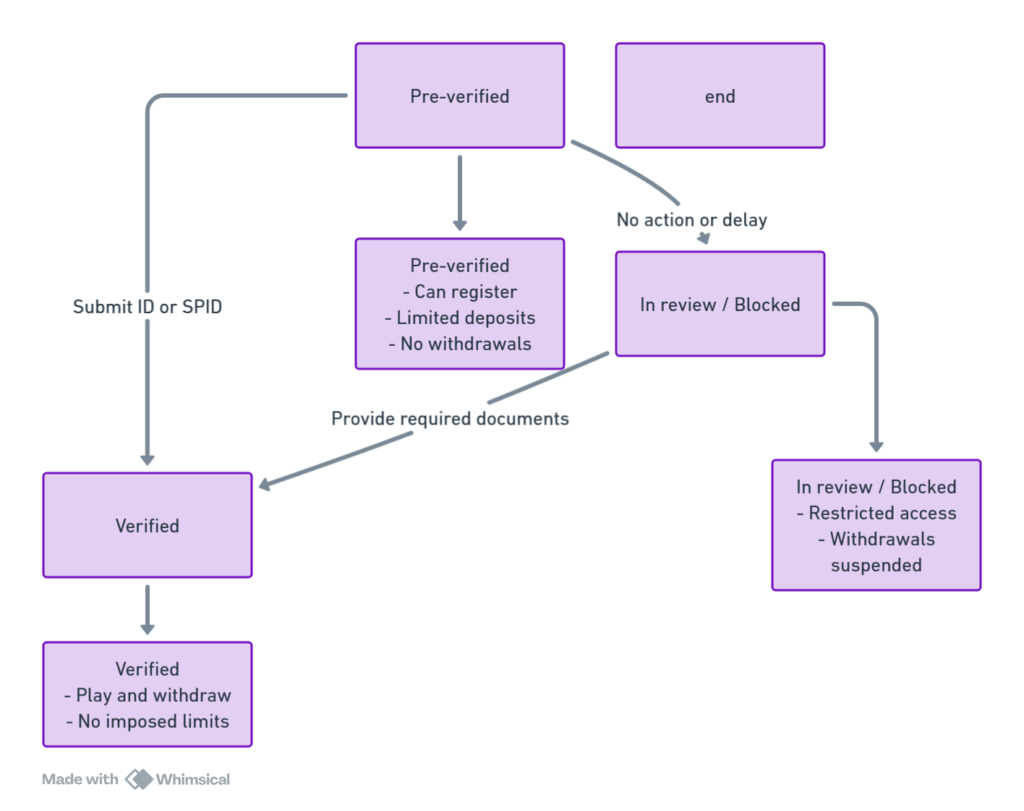

Italian operators commonly classify accounts by their KYC progress:

| Account status | What you can do | Typical limits | Next step |

|---|---|---|---|

| Pre-verified | Register, deposit small amounts | Withdrawals disabled | Upload ID or complete SPID |

| Verified | Full play and withdrawal rights | Only self-imposed limits | Full access |

| In review / Blocked | Limited access | Withdrawals paused | Submit requested documents |

Certain platforms may also impose a minimum deposit – often €5 or €10 – before unlocking bonuses or specific payment methods. These thresholds tie directly into responsible gambling principles and KYC obligations.

Italy’s widespread adoption of SPID and CIE has dramatically shortened verification times. Combined with automated document checks, AI-driven image recognition, and liveness testing, the process is both safer and more efficient.

The GDPR requires operators to clearly explain:

Verified identity is also what allows nationwide self-exclusion systems to work across all licensed operators. If a player chooses to self-exclude, the block is applied universally.

Italy’s KYC framework is considered one of the toughest in Europe, a point highlighted by Wikipedia’s overview of Gambling in Italy.

The UK, for example, emphasises affordability and age checks, while Italy prioritises digital identity verification and transaction traceability, resulting in a tightly controlled but secure environment. Leading European platforms such as Marathonbet are gradually adapting their onboarding models to align with Italy’s rigorous approach, enhancing verification technology and player protection.

A mid-tier operator added SPID as an alternative to manual uploads. In just three months, KYC completions climbed from 72% to 84%, with onboarding time reduced by nearly one-third.

A sudden attempt to withdraw a high amount to a third-party card triggered AML alerts. After requesting proof of funds, the operator uncovered inconsistencies and closed the account – demonstrating the value of strong KYC and EDD controls.

| Metric | Definition | Why it matters |

|---|---|---|

| KYC pass rate (first attempt) | % of users verified without retry | Shows how smooth the process is |

| Time to first withdrawal | Time from signup to first payout | Indicates overall efficiency |

| Enhanced due diligence cases | Share of users requiring deeper checks | Reflects risk management quality |

| Onboarding drop-off rate | % of users quitting during KYC | Highlights friction sources |

Tracking these indicators weekly helps operators quickly detect and fix weak points in their onboarding.

In Italy, KYC has evolved from a simple formality into a cornerstone of trust – safeguarding players, ensuring operator legitimacy, and reinforcing the integrity of the regulated market. With SPID integration, stronger privacy frameworks, and ever-faster verification tools, compliance is becoming smoother and safer for everyone.

For players, understanding the process makes registration and withdrawals more predictable.

For operators, strong KYC systems and transparent onboarding build credibility – as demonstrated by major brands like SNAI, William Hill, and Marathonbet.

Ultimately, KYC is not an obstacle but the backbone of a secure and responsible Italian betting environment.