This article was created by AI and verified by a human for accuracy.

Online betting has grown into far more than simply predicting outcomes. With breakthroughs in artificial intelligence (AI), mobile connectivity, social media, virtual reality (VR), and blockchain, gambling sites are now delivering highly immersive and personalized experiences.

Innovation continues at a remarkable pace, yet the rollout of these technologies – and the regulations that control them – remains uneven across regions.

AI now powers the core of modern sportsbooks and casinos. It processes massive volumes of data – player stats, injury reports, even weather forecasts – to adjust odds instantly

Machine-learning algorithms also examine betting activity to create custom offers and flourish patterns. Meanwhile, blockchain technology adds a layer of transparency through distributed ledgers and smart contracts that can execute payouts automatically, minimizing fraud.

VR and augmented-reality innovations are opening the door to a new type of engagement, where bettors can virtually sit courtside, wave to place a wager, and view live odds suspended in front of them.

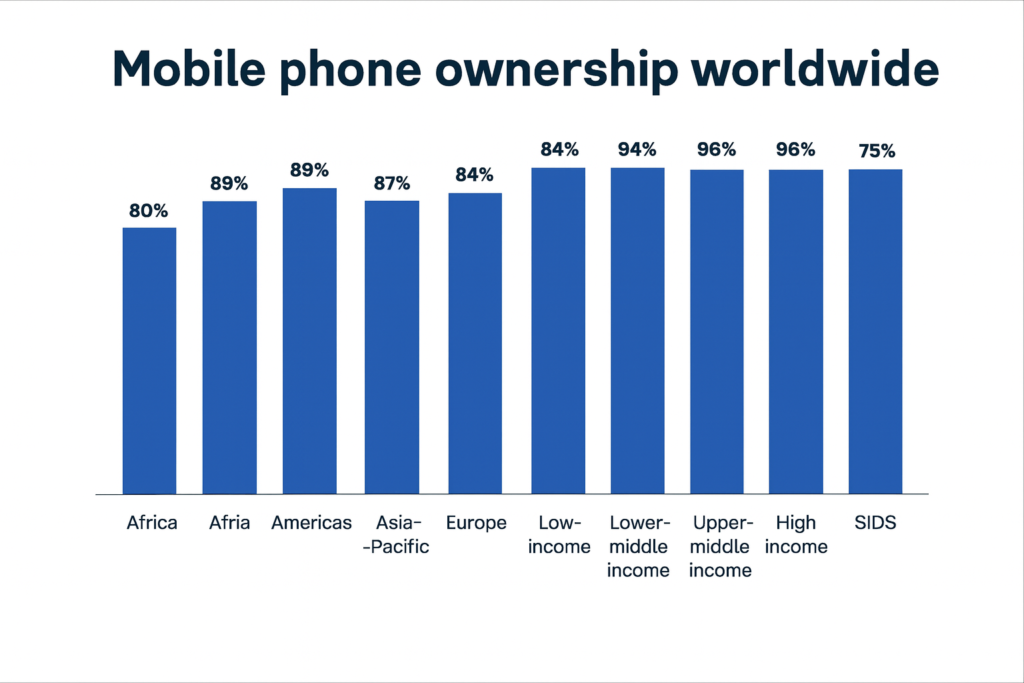

Access to these advanced experiences varies greatly around the world. In developed regions like North America and Europe, smartphone penetration exceeds 95%, and 5G networks reach most users.

Such infrastructure supports app-driven ecosystems where players can bet, cash out, and interact with live dealers in seconds. The Asia–Pacific region shows similar smartphone adoption but faces gaps in rural network coverage, while Latin America is rapidly advancing – over 80% of adults in Brazil and Mexico own smartphones.

In contrast, parts of Africa and the Middle East remain behind, with mobile access near 78%. Payment systems differ just as widely: Brazil’s PIX platform handles deposits in seconds, while cryptocurrencies are used by only about 8% of bettors.

These disparities influence design priorities. Platforms in highly connected markets feature HD streaming and biometric logins, while those in emerging economies rely on lightweight web versions or SMS-based interfaces. Regulation adds another hurdle – countries like the UK and Colombia enforce strict online gambling laws, whereas others, such as Chile, still operate without clear guidelines.

Leading betting companies are testing creative new formats to differentiate themselves. BetMGM, in collaboration with Inspired Entertainment, launched Hybrid Dealer Roulette, merging computer-generated tables with pre-recorded hosts to replicate a live-dealer vibe without a physical studio. The same brand also introduced Position Payout, allowing users to wager on a horse’s exact placement – an idea gaining traction in the UK, Ireland, and Australia.

In the U.S., FanDuel unveiled YourWay, a parlay builder giving NFL and NBA fans full flexibility to mix and match markets. It’s paired with a machine-learning-based Real-Time Check-In system that nudges players to manage deposits responsibly. Meanwhile, DraftKings, after acquiring Railbird, is moving into prediction markets with a platform that will let players trade contracts on events ranging from politics to pop culture.

Latin America perfectly illustrates the balance between tech progress and regulatory uncertainty. Mobile devices dominate, serving as the primary access point for most bettors. Compact, low-data apps offering live stats, streaming, and instant cash-outs have become standard. AI tools now drive tailored promotions and manage betting risk.

Still, regulation is inconsistent. Some countries have introduced licensing systems, while others are only drafting them. In Chile, for instance, the Superintendencia de Casinos de Juego (SCJ) states that only government-approved lotteries, racetracks, and licensed casinos can legally run betting operations. Until lawmakers finalize new rules, offshore or grey-market operators continue to serve local users through mobile-friendly platforms.

Despite these legal limitations, Chile stands out technologically, with some of the region’s fastest next-generation networks. Yet until legislation evolves, players must navigate a legally ambiguous environment.

Latin America’s betting scene showcases strong mobile usage, new payment options, and diverse regulatory approaches.

Smartphones are central to the region’s betting culture – over 80% of adults in Brazil and Mexico own one. Operators build platforms for fast load times and low data use, integrating real-time stats, quick cash-outs, and live video streams. Social media also fuels engagement: research shows 70% of bettors on Twitter/X interact with content during events, often placing bets when trending topics or influencer picks appear – highlighting how real-time posts and odds widgets directly affect wager behavior.

Instant transfer systems dominate deposits and withdrawals. Brazil’s PIX, endorsed by the Central Bank on its official site, leads adoption, while Peru’s Yape and Plin, and Argentina’s Transferencias 3.0, offer comparable services. Cryptocurrencies remain limited – only about 8% of Brazilian bettors use them – largely due to regulatory preferences for traditional banking methods.

Operators across the region leverage advanced analytics and AI to predict churn, tailor bonuses, and dynamically adjust odds. Coupled with widespread smartphone usage, these capabilities enable hyper-targeted marketing and loyalty programs with gamified features.

Colombia has a fully legalized framework, while Brazil, Peru, and Argentina are introducing their own versions. Chile, however, is still in the legislative stage. This uncertainty influences both investment and innovation; companies in unregulated territories must balance compliance risk with user demand.

Chile’s digital readiness is strong – smartphone ownership is high, and 5G already covers 82% of the population, serving over two million users. Yet the absence of local online-betting licenses curbs domestic growth. Still, several brands have localized their offerings for Chilean customers:

The future of betting will depend on more than just new devices. As AI becomes more advanced, regulators must ensure it’s used ethically and does not exploit vulnerable players. VR could redefine how fans experience live sports – but only if fast networks and affordable hardware become widely available. Ultimately, betting’s next chapter will be influenced as much by legal reform and financial innovation as by technological advancement.

Q: How do AI and machine learning enhance online betting?

A: AI processes vast data sources – such as weather updates and team stats – to calculate live odds. Machine-learning systems also track user activity, adjusting offers and issuing responsible-gaming alerts.

Q: What role does blockchain play in gambling?

A: Blockchain’s decentralized ledgers and smart contracts create transparent, tamper-proof records for wagers and payouts, reducing fraud and automating settlement.

Q: Why is Latin America seen as a mobile-first betting region?

A: Widespread smartphone use and instant payment tools like PIX make mobile betting the default mode. Platforms are designed for seamless performance on handheld devices.

Q: Why is Chile’s betting industry still unregulated?

A: Despite strong 4G and 5G infrastructure, Chile has yet to finalize online gambling laws. Until legislation is enacted, the market operates in a legal grey area.